Web3? I have my DAOts

The promise of a decentralized and trustless future is forever just that: a promise, and in the future.

David Letterman: I can remember a couple of months ago there was a big breakthrough announcement that on the internet, or on some computer deal, they were going to broadcast a baseball game. You could listen to a baseball game on your computer. And I just thought to myself, does radio ring a bell?

(laughter)

Bill Gates: There’s a difference. It’s not a huge difference.

David Letterman: What is the difference?

Bill Gates: You can listen to the baseball game whenever you want, too.

David Letterman: Oh, I see. So it’s stored in one of your memory deals and then you can come back and a year later —

Bill Gates: Exactly. That’s the RAM that we talked about earlier.

(pause)

David Letterman: Do tape recorders ring a bell?

- Bill Gates on Late Show with David Letterman, November 27, 1995

No one wants to sound like David Letterman.

The terror of missing the next big thing - a sentiment so universal it has its own acronym: FOMO - is reason enough to think twice before dismissing the latest tech obsession.

Which brings me to the phenomenon that’s taken over my Twitter feed recently: web3.

What is web3?

Good question. Let’s toss it over to the folks at Ethereum.org:

Web3, in the context of Ethereum, refers to decentralized apps that run on the blockchain. These are apps that allow anyone to participate without monetising their personal data.

They also helpfully include this table:

Slate published what I think is roughly the most commonly accepted (and comprehensive) definition of web3:

Web3 refers to a potential new iteration of the internet that runs on public blockchains, the record-keeping technology best known for facilitating cryptocurrency transactions. The appeal of Web3 is that it is decentralized, so that instead of users accessing the internet through services mediated by the likes of Google, Apple, or Facebook, it’s the individuals themselves who own and control pieces of the internet. Web3 does not require “permission,” meaning that central authorities don’t dictate who uses what services, nor is there a need for “trust,” referring to the idea that an intermediary does not need to facilitate virtual transactions between two or more parties. Web3 theoretically protects user privacy better as well, because it’s these authorities and intermediaries that are doing most of the data collection.

So web3 is primarily about using blockchains to build apps that are independent, permission-less, and decentralized, and where the value produced in the economy is largely captured by content creators themselves. This is primarily made possible via “smart contracts,” pieces of code that run on the blockchain and execute actions automatically based on specific conditions (e.g. “send 10 ether from X to Y if X has >= 10 ether in its wallet”). Smart contracts are often compared to vending machines: if you insert the right amount of money, the machine gives you a candy bar.

This decentralized and deterministic schema stands in contrast to the status quo ante (web 2.0), where much of our tech infrastructure and culture is trapped inside highly centralized corporate walled gardens that retain most of the monetary value produced by their network of users.

I was a child when that David Letterman interview aired, but to the extent that I’m loosely familiar with the era, his views were rather in line with conventional wisdom. As another example, here’s future Nobel Prize winner Paul Krugman writing three years after the Letterman/Gates interview, in 1998:

The growth of the Internet will slow drastically, as the flaw in ‘Metcalfe’s law’ — which states that the number of potential connections in a network is proportional to the square of the number of participants — becomes apparent: most people have nothing to say to each other! By 2005 or so, it will become clear that the Internet’s impact on the economy has been no greater than the fax machine’s.

I’ve been thinking about these catastrophically bad predictions lately, because much of the recent online discourse around web3 — not unlike the internet enthusiast discourse circa 1995 or even 1998 — has the disquieting air of a cult.

And like a cult, the urge to dismiss or mock it (“covered wagon!?”) is nearly overpowering.

So is the hype real?

I write all of the above as a sort of throat-clearing exercise. That is, I’m sufficiently wary of casting my lot with the likes of David Letterman and Paul Krugman that I want to disabuse myself of my skepticism if there’s actually a web3 there there.

As Will Wilkinson agonized in his own piece — spoiler: he entered the web3 rabbit hole and emerged as a convert — part of the difficulty with evaluating web3 is the intensity of opinion by intelligent people on both sides:

However, a few of my best and smartest friends are deeply into crypto stuff and know more about it than I do. One of my personal epistemic precepts is that if I disagree with somebody who is (a) at least smart as I am, (b) has generally sound judgment and (c) is better informed on a subject, then I ought to concede that I’m probably wrong and revise my opinion in their direction. The trouble is, I also know plenty of people who satisfy all these conditions but think crypto is unmitigated bullshit.

As for me, the more I read about web3, crypto, DAOs, NFTs, etc., the more dubious the whole ecosystem appears. So while this is unlikely to be my final viewpoint on all things web3, below represents my top 7 reasons — some of which overlap — to be highly skeptical about its usefulness.

#1: The technical details don’t support the grandiose claims of trustlessness and decentralization

The web3 fandom discourse is densely populated by a cohort of people that are extremely excited about the future possibilities enabled by decentralized and trustless networks and can (sort of) explain, in broad, hand-wavy terms, to an uninformed public why this might matter.

These are people like former Planet Money founder Adam Davidson: “I believe that [web3] will be enormously consequential for nearly all forms of human interaction.”

Or, perhaps more absurdly, podcaster and crypto enthusiast Aaron Lammer1:

I do think there are ways where crypto comes out of a reckoning of the 2.0 internet. I think I’m stealing this line from somebody, but you remember the Google slogan “Don’t be evil,” right? Well, that was sort of a recommendation; it wasn’t, like, law. But what if it were?

The problem is that this cohort’s claims, while perhaps immediately graspable, often collapse under light scrutiny. Take the Ethereum Name Service, for example. Designed as a sort of wholly decentralized version of DNS, the architecture that underpins the internet, ENS’s own FAQ page acknowledges (emphasis mine):

The root node [under which all ENS domains are registered] is presently owned by a multisig contract, with keys held by trustworthy individuals in the Ethereum community. We expect that this will be hands-off, with the root ownership only used to effect administrative changes, such as the introduction of a new TLD, or to recover from an emergency such as a critical vulnerability in a TLD registrar.

Or look at The Render Network, the self-described “leading provider of decentralized GPU based rendering solutions, revolutionizing the digital creation process.” Its whitepaper’s section on fraud prevention states (emphasis mine):

Additionally, other features are built into the network to verify render jobs - these features will not be made public in order to not divulge information to those looking to take advantage of it.

Or take a peek at NBA Top Shot, the subject of an earlier post of mine on NFTs, which are a key component of web3:

Top Shot’s help page says that “NBA Top Shot is the home for NBA fans to collect Moment™ collectibles of their favorite stars and team” and continues (emphasis mine):

An NFT is a one-of-a-kind, non-fungible, cryptographic token representing a unique digital asset for which there is no copy or substitute…

Each moment is secured by the blockchain, meaning your Moment is Unique and Licensed by the NBA and NBPA.

And yet the very same site’s Terms of Use reads (in part, and emphasis mine):

For the sake of clarity, you understand and agree: (a) that your purchase of a Moment, whether via the App or otherwise, does not give you any rights or licenses in or to the App Materials (including, without limitation, our copyright in and to the associated Art) other than those expressly contained in these Terms; (b) that you do not have the right, except as otherwise set forth in these Terms, to reproduce, distribute, or otherwise commercialize any elements of the App Materials (including, without limitation, any Art) without our prior written consent in each case, which consent we may withhold in our sole and absolute discretion…

In each of these cases, either decentralization or trustlessness or ownership (or some combination) turns out to be a mirage.

Which leads me to…

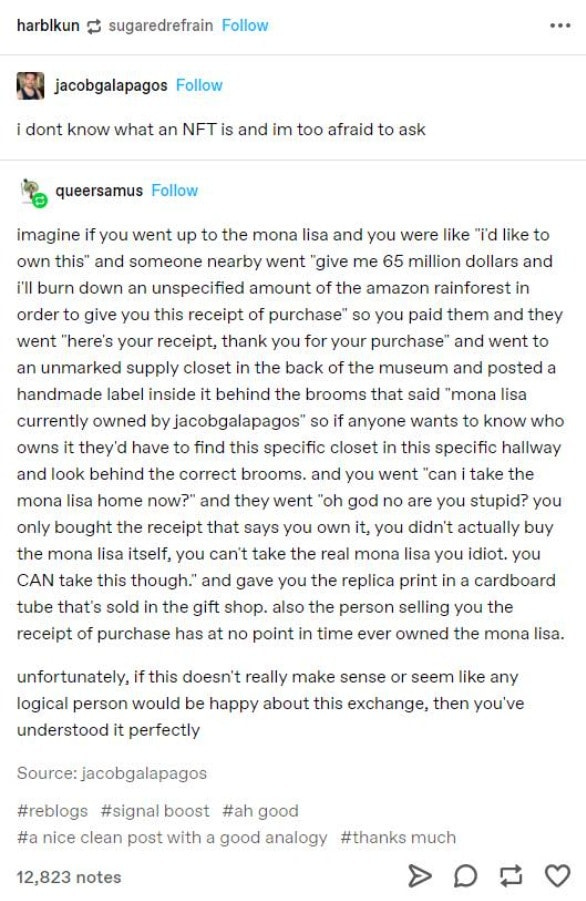

#2: NFTs prove neither ownership nor uniqueness

Fans of non-fungible tokens, or NFTs, say they have the potential to upend internet-era economics of infinite supply and restore artificial scarcity. Here’s a fairly typical description:

That means that, for the first time, it's possible to prove ownership of a digital artwork, and for digital art to have provable scarcity.

By encoding ownership of a unit of digital content — say, a piece of artwork — directly and immutably on a public blockchain, NFT boosters claim that scarcity can be created out of cryptographic thin air. As a digital artist, for example, I can decree that only ten copies of my JPEG art exist, and then auction them off one by one, with each owner obtaining one of only ten “unique” copies.

But this isn’t true. NFTs don’t prove you own anything:

In other words, someone copied and pasted this guy’s real-life artwork, created an NFT out of it — which is usually nothing more than a reference to a piece of art already existing either online or in the real world — and sold it for $170,000. And there’s nothing stopping anyone else from doing this, either.

We know this because it keeps happening:

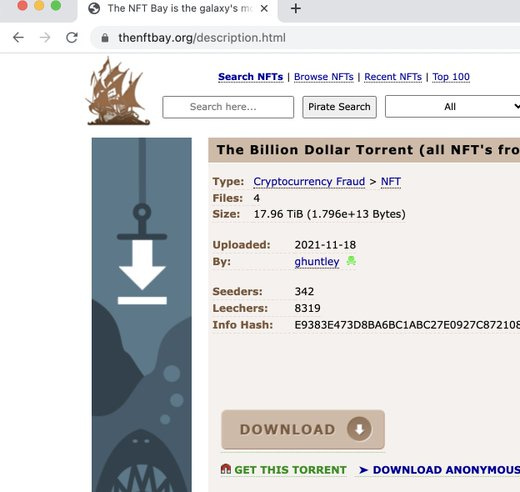

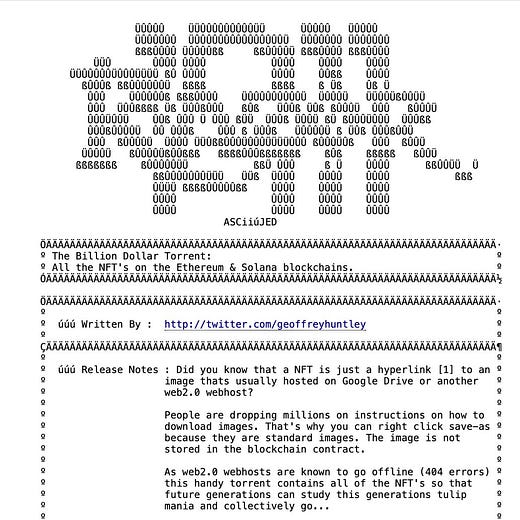

Thieves have stolen bored ape NFTs. They’ve stolen from dead people. They’ve created a performance-art parody of The Pirate Bay called The NFT Bay that literally consists of thousands of “stolen” JPEGs:

NFT theft is so common, in fact, that there’s an entire Twitter account dedicated to NFT theft. It’s called @NFTtheft.

And that’s not the worst of it: for a variety of reasons too boring to go into here, the content of the NFTs — the artwork itself — often isn’t stored on the blockchain. Only a link to it is:

Traditional URLs pose real problems for NFTs. The owner of the domain could redirect the URL to point to something else (leaving you with, perhaps, a million-dollar Rickroll), or the owner of the domain could just forget to pay their hosting bill, and the whole thing disappears.

In other words, NFTs are less like a digital version of a rare LeBron James basketball card and more like a piece of paper with written instructions for where to find the card in a specific apartment located in a building that may or may not have been razed several years ago.

#3: Most product ideas for web3 have preexisting counterparts that already work pretty well

This most obviously applies to financial transactions themselves, which are the entire point of the OG web3 project: Bitcoin. (The Bitcoin whitepaper, published by the pseudonymous Satoshi Nakamoto in 2008, is literally titled “Bitcoin: A Peer-to-Peer Electronic Cash System.”)

Bitcoin currently has the capacity to process about 4 transactions per second. Ethereum can process about 15.

Visa processes 1,700.

The dissonance extends beyond mere transaction throughput to the availability of financial products generally. Web3 is often inaccurately credited for feature sets that long predate it:

Or take “composability.” Web3 enthusiasts are particularly excited about the stackable LEGO effect made possible by smart contracts:

Smart contracts go beyond simply allowing for instant and verifiable transactions for various applications though — they can also be programmed to interact with each other. In other words, they make crypto programs composable, like building blocks…Because composability allows anyone in a network to take existing programs and adapt or build on top of them, it unlocks completely new use cases that don’t exist in our world.

But composability is hardly new. APIs — which have been around for decades — are atomic units of composability. Anyone who’s used Zapier, IFTTT, or Workato intuitively comprehends that composability is not an innovation introduced by web3.

These examples go on and on. Adam Davidson published a piece last month titled “Real world problems that web3 could solve—at least for me.” In it, he cited numerous features as new or groundbreaking possibilities opened up by web3: the ability to record proof of meeting attendance, display projects and courses and communities on a personal digital profile page, send “tips” to people who’ve been helpful to you, or empower workers to “have a portfolio of projects, rather than a single job.”

If these things sound like Zoom, LinkedIn, Buy Me a Coffee, and…um, freelancing, congratulations: you’ve been alive and online for more than five minutes.

Do tape recorders ring a bell?

#4: Core features of crypto and web3 aren’t actually desirable to most people

It’s not just that some of the analog, or web2, iterations of products work as well as, or better than, their web3 counterparts in some abstract or theoretical sense. It’s that real people prefer them as well.

Think about Bitcoin. If you live in the US, and you’ve ever bought Bitcoin, chances are you probably did so by signing up for an account with Coinbase or Robinhood (or a similar centralized exchange or trading platform).2 You connected your USD bank account and deposited cash into your Coinbase account.

The key thing here is that, by doing this, you’ve discarded a core advantage of cryptocurrencies. Crypto enthusiasts like to repeat the maxim “not your keys, not your coin” — meaning that unless you have sole control of the private key to your cryptocurrency wallet address, you don’t actually own the coins. (They say this because, just as with NFTs, cryptocurrency theft is a constant threat.)

But by holding your cryptocurrency on Coinbase (a “custodial” wallet, so called because Coinbase holds the private keys, and thus your cryptocurrency, on your behalf), you have to trust Coinbase to take care of your crypto for you, to protect against hacking, and to withstand subpoenas or orders to freeze your account from the US government. (This is both legally and historically not a good bet.) You’re also implicitly signing off on the benefit of (or at least you’re not particularly bothered by) Coinbase’s adherence to “know your customer” and anti-money laundering regulations.

All of which suggests that maybe what’s attracting so many people to crypto isn’t the libertarian philosophical underpinnings or the technological breakthroughs in decentralization so much as it’s:

As Robin Sloan writes:

A large fraction of Web3’s magnetism comes from the value of the underlying cryptocurrencies. Therefore, a good diagnostic question to ask might be: would you still be curious about Web3 if those currencies were worthless, in dollar terms? For some people, the answer is “yes, absolutely”, because they find the foundational puzzles so compelling. For others, if they’re honest, the answer is “nnnot reallyyy”.

But it’s not just trustlessness that’s unpopular. The immutability of a distributed, public blockchain is one of its primary differentiators from traditional databases. The problem is, people often don’t want immutability.

If you’ve ever been the victim of identity theft and had funds fraudulently removed from your bank account or charges added to your credit card balance, the reversibility of transactions is something you’ve almost definitely benefited from. It’s not a bug; it’s a feature.

Speaking of bugs, they appear routinely in smart contracts, with catastrophic results:

As Stephen Diehl writes, “These disasters happen about two or three times a week now because coding at that level of correctness required in a Javascript-like language with loose and ill-defined semantics is near impossible.” More to the point, on a truly decentralized and trustless network, those losses are also irreversible — because no one has the authority to do so.

And that’s before we even get to the countless stories of people and companies losing cryptocurrency because:

their private keys to $280 million in Bitcoin were stored on a hard drive they threw away

they accidentally transferred crypto to the wrong address

$115 million was stolen via a hack of a DeFi (decentralized finance) web UI

they got duped by one of the endless scams in the crypto ecosystem

Oh, and this thing, which happened to crypto exchange BitMart while I was writing this newsletter:

Imagine if personal bank accounts were this rife with fraud!

Of course, as covered above, there are ways to mitigate some of the worst risks, such as by storing your coins with one of the more reliable firms like Coinbase. In his post on web3, Mischa Spiegelmock explains:

Just as we have banks to relieve us of the need to stash money under our mattresses, trusted (and scammer) establishments with customer support phone numbers and backups will pop up to service the general populace and hold on to their private keys.

But therein lies the rub. If you’re prepared to discard trustlessness and decentralization, there needs to be something else blockchains are better at than the established alternatives. And it’s not at all clear what that is. (See points #5, #6, and #7 below.)

Many of the spectacular blowups mentioned here are the inevitable consequence of deliberate design choices — specifically, the philosophy that blockchain activity is immutable and irreversible.

The design choice is just that — a choice. And in an ironic twist, no one understands the chosen design’s undesirability better than web3’s founding fathers, because — in one of the most (in)famous episodes in crypto history — the premier layer-1 blockchain, Ethereum, reversed a fraudulent transaction entirely, to the tune of approximately $60 million.

#5: Inscribing governance in code doesn’t resolve real-world conflicts over competing values

Quick glossary check: a DAO is a decentralized autonomous organization, whose governance rules are set by smart contracts executed on a blockchain. You can think of it as a corporate-like entity or venture fund with programmatically enforced bylaws. Generally, the more money and/or time you invest in a DAO, the more control you gain over its governance, via the distribution of crypto tokens. (Now, is a securitized popularity contest actually a good way to run an organization? See point #4.) DAOs are often cited as one of the more genuine innovations enabled by web3, especially in comparison to the wild-eyed speculative gold rush often associated with cryptocurrencies.

The first DAO to rise to prominence was “The DAO,” founded in 2016 on Ethereum. It raised $150 million worth of ether in order to crowdfund new projects on the blockchain. But it didn’t last even three months before a hacker exploited a vulnerability and stole about $60 million worth of ether.

A debate quickly broke out among developers and victims of the hack: what should be done? On the one side were those advocating the purist crypto stance: the smart contract is a sort of digital law, and by the rules of that law as written — buggily, as software often is — the hacker was able to withdraw about $60 million of ether. Ergo, by definition the hacker was playing by the rules as they existed and nothing “wrong” had occurred.

On the other side3 were advocates of a “hard fork,” a proposal to reverse all the hackers’ transactions and lop them off the blockchain as if they had never happened, thus restoring the victims’ funds.

Ernesto Frontera describes the thorny dilemma:

The “code is law” advocates had a point: how would a hard fork be any different than standard central banking procedures like “bail-outs”? The intervention of central developers into the monetary policy of Ethereum worried many.

You can probably guess where this is going. Common sense prevailed, and the hard fork proposal won, returning the “stolen” funds to their victims. This modified, not-at-all-irreversible blockchain still powers Ethereum today.

In fairness, the losers didn’t exactly walk away with their tails between their legs. They continued the original “pure” blockchain — complete with hacked funds — as “Ethereum Classic,” which also still exists. But it’s considerably less popular than its “sellout” sibling: the total value of ether outstanding is currently just below $500 billion, while Ethereum Classic’s total value is just 1 percent of that.

The episode of The DAO demonstrates that, when push truly came to shove, participants in the world’s dominant smart contract platform simply decided that immutability was…mutable.

More importantly, the hard fork exposed the stark limits of smart contracts’ power: code is totally deterministic, but if the broader (one might say “societal”) expectations of what that code should do turned out to differ from the reality of what it did, then smart contracts aren’t really all that smart. (See point #6 below.) They’re just code. And like all code, the outcomes they produce represent specific social values. If those values come into conflict with those of the broader community, either the community’s views must prevail or you end up with authoritarianism.4

To his credit, the creator of Ethereum, Vitalik Buterin, came close to acknowledging this himself in the wake of The DAO hack:

All instances of smart contract theft or loss - in fact, the very definition of smart contract theft or loss, is fundamentally about differences between implementation and intent…This leads to the next challenge: intent is fundamentally complex.

#6: Smart contracts aren’t smart

This point initially looks the same as #5, but it’s not. #5 is specifically about the inability of code to referee among competing values systems. Point #6 is that the limitations of smart contracts innately prevent them from producing much real-world value at all.

To understand this, you have to remember why web3 backers are so excited about smart contracts. Their key advantage is that they are deterministically-executed code packages representing an agreement between counterparties: the code executes once the blockchain has validated that certain underlying conditions have been satisfied. There’s no human or manual process required: when a smart contract’s conditions are achieved, the outcome is predetermined.

But in order for this to work, all (or at least most) of the nodes on the blockchain - the thousands of servers all running the same Ethereum Virtual Machine (EVM) software that powers the network — have to agree that the underlying conditions have been satisfied in the first place.

Therein lies the first problem. These nodes cannot independently evaluate the truthiness of almost any underlying conditions whatsoever, except for the very limited set of conditions directly relating to activity that has occurred on the blockchain itself (such as the balance of specific wallets). In other words, to ensure deterministic outcomes based on a condition, the condition has to be deterministically evaluable as well: otherwise the EVM nodes may disagree about whether the smart contract should be executed or not.

For this reason, some of the top use cases you often see written about for smart contracts are in lending (for example, via Aave) and margin trading: a creditor can use a smart contract to programmatically lend crypto-denominated funds to someone and automatically be repaid, with interest, on a set schedule. (Similarly, a brokerage can enable margin accounts for their clients.)

But how does one programmatically assess creditworthiness, you ask? Answer: you don’t have to, because these loans are over-collateralized. For every, say, Shiba Inu coin you borrow, you have to put up — in digital escrow, effectively — a greater value of ether (or perhaps Tether5) as collateral. If the value of your borrowed asset falls relative to your collateral6, your creditor automatically takes possession of the collateral.

You can see how this is necessarily limiting. Unlike what I can do with my credit card right now — rack up thousands of dollars of charges without putting up any cash in advance, because I have previously established myself as creditworthy — a loan like this can only be made to someone with more funds in cryptocurrency than they are trying to borrow, which also must be a cryptocurrency.

This limiting scenario obviously lends itself to one primary use case: wild speculation on various cryptocurrencies. How wild does this financial speculation get, you ask? Well, for comparison, the maximum initial leverage that U.S.-based traditional brokerages can legally offer their clients is 2x. That is, “an investor can not borrow more than $1,000 to buy $2,000 worth of stocks within a brokerage account.” In practice, brokers often offer ratios even more conservative than that.

Until this summer, one of the leading crypto exchanges, FTX, allowed traders to leverage at a 100x ratio. That’s right: a 1% drop in the value of your leveraged bet would wipe out your entire position. When FTX finally announced in July they were going to reduce this ratio, they changed it…to 20x.

Now I’m trying to be sympathetic here: like many web3 denizens, FTX CEO Sam Bankman-Fried wasn’t old enough to legally smoke a cigarette during the Great Financial Crisis. So this grumpy elder millennial would just like to gently remind web3 folks who are enthusiastic about financial product innovation that — when it comes to devising highly leveraged financial instruments — web3 is not, ahem, our first rodeo.

As a side note, enabling frictionless financial speculation is a particularly odd triumph to hang web3’s hat on in an era where a 30-year fixed mortgage rate is currently 3.11%. It would be like announcing a major breakthrough in how to become unemployed in 1931. Money is practically falling from the sky: neither a smart contract nor even a particularly smart person is required to find funding for just about anything. Hell, four years ago a startup selling a $400 fruit juicer boasted $120 million in venture capital funding in a higher interest-rate environment than the one we have now.

The reason I’ve taken you down such a lengthy rhetorical detour is this: to achieve anything more interesting than over-collateralized lending or absurdly leveraged margin trading with smart contracts, you pretty much have to use an oracle. (Not, like, Oracle. Just an oracle.) An oracle is a method for obtaining off-chain, real-world data — like today’s weather in New York, or the current Dow Jones Industrial Average, or the winner of the last presidential election — and making it available on the blockchain.

Chainlink, a leading oracle provider, reiterates the blockchain’s inherent limitations I walked through above, in explaining why oracles are so central to doing anything useful on the blockchain:

The oracle problem revolves around a very simple limitation—blockchains cannot pull in data from or push data out to any external system as built-in functionality. As such, blockchains are isolated networks, akin to a computer with no Internet connection. The isolation of a blockchain is the precise property that makes it extremely secure and reliable, as the network only needs to form consensus on a very basic set of binary (true/false) questions using data already stored inside of its ledger.

But guess what happens when you use oracles to pull in useful data? There goes trustlessness, right out the window.

Oracle providers rely on a marketplace of data sources — for example, the Associated Press can be queried for election results via API (there’s composability again!) — to bring external data into the blockchain. That means the data has not been subjected to the same consensus validation methodology central to web3.

In short, it means you have to trust someone. And like anything that involves trusting other people, sometimes that trust turns out to be misplaced. That is, when the oracle itself is compromised, so is your transaction that relies on it.

A smart contract, therefore, isn’t very smart at all. The universe of data types that can be validated trustlessly on the blockchain is infinitesimally small, but to expand that universe requires relying on external institutions like those dirty hippies over at the Associated Press.

#7: Smart contracts aren’t contracts

The advantage of smart contracts is their determinism: given the presence of certain inputs, a given output is assured.

This epistemological certainty does not survive first contact with humans. Although they are called “smart contracts,” there is nothing inherently legally enforceable about anything that happens on a blockchain.7 The term “contract” is really a misnomer for "code execution.”

And just as validator nodes are only able to independently verify data that is already on the blockchain, the execution side of a smart contract is similarly limited in scope: nothing can be “executed” on the blockchain that deterministically affects the real world with a specific outcome.

This is because the real world is complex and ever-changing. For example, imagine a theoretical smart contract that could e-sign a deed of property from its owner, Person A, to a wallet belonging to Person B, provided that Person B has sufficient funds to pay for the property.

While the underlying condition could potentially be validated with certainty using blockchain data alone (does Person B have sufficient funds?), there is nothing preventing Person A from, for example, already having sold his property to someone else beforehand. What is the enforcement mechanism to prevent this from happening?

Well, you say, a smart contract can be designed such that both the buyer and seller have to put in collateral funds, and in the case of a breach the victim automatically receives the breacher’s collateral. But then how is the existence of a breach determined?

No matter how far down the road you punt the problem, eventually you must confront the fact that the outcomes of human interaction are inherently and necessarily nondeterministic, and thus cannot be resolved using only a blockchain or any other programmatic resolution mechanism. This is not a bug, but a feature, of being human.

It’s also why the court system exists. If we could simply programmatically determine outcomes for every real-life situation without the rather messy and arbitrary juridical process this often entails, we would be no better than robots ourselves.

The unreality of the “contract” half of smart contracts is also why NFTs can’t prove ownership or uniqueness or, really, much of anything at all. Smart contracts are inherently self-referential. It’s why an NFT only proves that a specific address says it owns something, rather than proving it actually does. It’s why virtually the entire DeFi ecosystem is an M.C. Escher universe of self-referencing financial speculation that either never touches anything tangible or requires oracles — that is, trust — to do so. (If you want to feel dizzy for free, try reading up on “flash loans.”)

So where is web3’s killer app?

It’s been 13 years since Satoshi Nakamoto published his Bitcoin whitepaper. In all that time, the closest the crypto ecosystem has come to creating mainstream “killer apps” are ransomware and online markets for illegal drugs.

Proponents of web3 often respond with a version of the argument that the emergence of web3 — which, to be fair, is more attributable to Vitalik Buterin’s Ethereum whitepaper in 2013 than Satoshi’s in 2008 — is akin to that of the internet itself: so vast and immeasurable in its potential future implications that it will take time to actually work backwards from the theoretical genius of the protocol itself into an array of practical applications that sit atop it.

And yet contrast this with the App Store on the iPhone, which was launched in July 2008, just 3.5 months before Satoshi’s whitepaper. One could write (and many have) entire books on the ways in which the robust app ecosystem that has blossomed from the App Store “platform” has changed the world. Not all of these changes are for the better, certainly, but virtually no one would question whether they exist in the first place.

Web3’s first years, it must be said, look quite different than the iOS App Store’s public journey since its initial introduction. Like a 17th-century Dutch tulip, web3 captures the imagination not for what it does but for how much money has been made and lost with it.

This befits a technology whose rhetoric is ever-soaring, whose potential remains open-ended, but whose lingua franca is borrowed directly from Wall Street: the buying, selling, swapping, and lending of tokens in DeFi; the forced reintroduction of scarcity via NFTs; and the securitization of governance via DAOs.

It was perhaps not web3’s original objective to serve as a signpost of human existence’s increasing hyper-financialization (see the linked tweet above for a non-web3 example), but to paraphrase Vitalik Buterin: there can be very big differences between implementation and intent.

For that same reason, I think people can genuinely believe they're obsessed with web3 because of its inherent interestingness when in fact it’s because web3 has made them a lot of money very quickly.

And yet…

You may have noticed that in this post I’ve focused on web3’s usefulness, not its financial value.

This is for two reasons.

First, debates about the future of web3 as an investment vehicle are inherently unfalsifiable (at least in the present). There’s no way to know: a single ether could be worth $1 million a decade from now, or it might not exist. It’s not just that I have no way of predicting which outcome is likelier, but I’m also somewhat bored by the conversation.

The second reason for focusing on web3’s functionality rather than its investment potential is that the answers to those two questions will not necessarily correlate with each other in the medium or even long term.

So to be clear, I am not saying that A) web3 is not particularly useful and B) therefore you should not invest in cryptocurrencies.8 I’m just saying A. A general dearth of functionality is hardly a guarantee of imminent, or even eventual, collapse. (If you’ve ever been a customer of an American internet service provider, you already know this well.) As the axiom goes, the market can remain irrational longer than you can remain solvent.

My caution stems partially from what I perceive as similar divergences in other sectors. As I wrote almost exactly a year ago about the ad tech industry, the status quo in any given market can feel unsustainable and yet continue to exist in seeming perpetuity:

In short, no, it is not clear that online advertising is a bubble. But one can forgive Tim Hwang for thinking it is. His fault lies not in being overly pessimistic, but rather the reverse: in order to pop a bubble, you first need a market that’s curious enough to poke around.

Are web3 participants curious enough to poke around?

Appendix: Reading List

While researching for this newsletter I ended up spiralling down a web3 rabbit hole myself. Below are a few of the resources I found particularly insightful in explaining and/or challenging various elements of the web3 ecosystem.

From contemptuous to indifferent to curious to pretty damn excited: my journey to web3

Real world problems that web3 could solve—at least for me

A Crypto True Believer Makes His Case

How Digital Art and NFTs Are Changing the Nature of Ownership

The Handwavy Technobabble Nothingburger

What is Web3? Should You Care?

Why NFTs are bad: the long version

So you want to use a price oracle

This Lammer quote is utterly ridiculous, but I nevertheless recommend his highly entertaining podcast miniseries, Exit Scam, about the mysterious collapse of the Canadian crypto exchange Quadriga.

Per Gemini: “As of September 2020, 95% of digital asset trades are executed through centralized exchanges, which represents approximately $228 billion USD a month.”

I’m oversimplifying slightly, as there was also a third group advocating a “soft fork.” But they didn’t end up winning the battle of ideas — or, rather, they briefly did until their fix also had a bug in it and had to be abandoned.

In fact, the meltdown just last month of yet another DAO, ConstitutionDAO — which was created as a crowdfunded (and ultimately unsuccessful) effort to buy a rare surviving copy of the U.S. Constitution, but devolved into finger-pointing and over $1 million so far in fees — serves as a further warning of the limits of using code as a proxy for governance.

Tether is a “stablecoin” that is either worth precisely $1.00, or $0.00 plus prison sentences for Tether’s entire C-suite.

But how does the smart contract know the exchange rate between the two cryptocurrencies in order to calculate if it needs to liquidate your collateral? Per Aave’s published Market Risk Assessment: “Overcollateralized protocols like Aave rely on price oracles that convey asset prices external to the blockchain to the protocol...Manipulation of oracle price feeds can force the protocol to liquidate liens that are not in default, causing a loss of customer funds.” Here’s a link to some of those oracles. So even for this relatively simple transaction, trustlessness once again proves to be a mirage.

You don’t have to take my word for it. Kaleido, a blockchain company, explains the same thing more succinctly: “Despite the name, smart contracts are neither smart nor legally binding.”

Despite my general bearishness on the web3 ecosystem overall, I hold modest investments in several tokens including Bitcoin, Ethereum, Solana, and Polygon.

The first video actually perfectly describes the difference.

In the 1995 internet, *you could already do stuff*. Of course, Letterman jokes about it, but. You could already write to people at news groups. As Gates replies, you could already read information about your weird interests. You could listen to baseball games. You know, do *actual stuff*.

With all this web3 stuff, you can just gamble. Gamble with NFT "investments", with DAOs, with different cryptocurrencies converting to each other (what's called "DeFi").

There is nothing really there.

What you *can* do, and what is new, is transferring money around regulators. Which is both good (getting money out/in of oppressive regimes); and of course bad (ransomware would not exist without crypto).

But that's not really "web3", is it.

So yeah if there is anything "there" there, it's just that - a way to transact on the internet without regulators. (There is still heavy weirdness around that there; all the goldbuggery, all the scams, but at least I can see *something* in the middle of the bullshit.)

This is probably the best essay about Web3 I've read! Fantastic job on breaking this down.