Introducing the Tether Insolvency Calculator

Is Tether solvent? Play around with my new calculator app to find out.

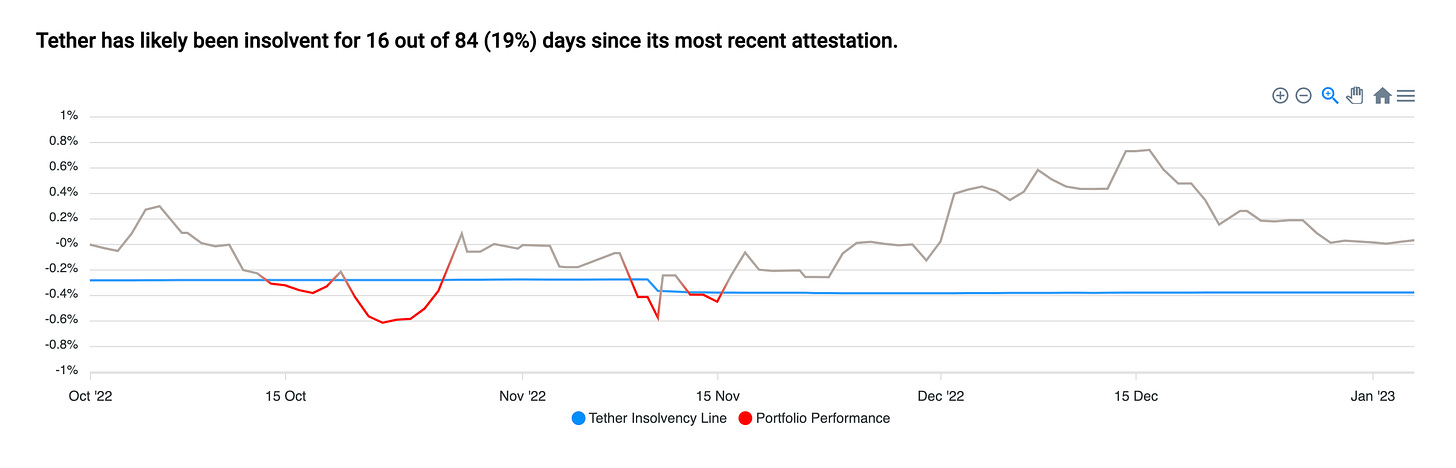

Today I released the Tether Insolvency Calculator at tethertransparency.com:

This is a project I’ve been working on over the past month or so. As a bit of background, Tether is a $66 billion cryptocurrency stablecoin which I’ve previously half-jokingly described as “either worth precisely $1.00, or $0.00 plus prison sentences for Tether’s entire C-suite.”

The point of stablecoins is right there in the name: they’re meant to be perfectly stable — that is, pegged 1-to-1 — relative to major fiat currencies, most prominently the U.S. dollar. In crypto, this is a valuable property for a token to have, because it enables margin lending and borrowing, provides a safe haven in times of market volatility, and reduces effective settlement times.

Of course, for a stablecoin to be truly pegged to a fiat currency, one has to be absolutely certain the stablecoin is backed by sufficient assets such that, if everyone demanded to redeem their Tether tokens for dollars at once, the funds would actually be there.

This has been a longstanding problem for Tether, which has been fined by both the CFTC and the New York attorney general precisely on this point. Per the CFTC:

As found in the order, Tether held sufficient fiat reserves in its accounts to back USDT tether tokens in circulation for only 27.6% of the days in a 26-month sample time period from 2016 through 2018.

And the NY AG:

The OAG’s investigation found that, starting no later than mid-2017, Tether had no access to banking, anywhere in the world, and so for periods of time held no reserves to back tethers in circulation at the rate of one dollar for every tether, contrary to its representations. In the face of persistent questions about whether the company actually held sufficient funds, Tether published a self-proclaimed ‘verification’ of its cash reserves, in 2017, that it characterized as “a good faith effort on our behalf to provide an interim analysis of our cash position.” In reality, however, the cash ostensibly backing tethers had only been placed in Tether’s account as of the very morning of the company’s ‘verification.’

On November 1, 2018, Tether publicized another self-proclaimed ‘verification’ of its cash reserve; this time at Deltec Bank & Trust Ltd. of the Bahamas. The announcement linked to a letter dated November 1, 2018, which stated that tethers were fully backed by cash, at one dollar for every one tether. However, the very next day, on November 2, 2018, Tether began to transfer funds out of its account, ultimately moving hundreds of millions of dollars from Tether’s bank accounts to Bitfinex’s accounts. And so, as of November 2, 2018 — one day after their latest ‘verification’ — tethers were again no longer backed one-to-one by U.S. dollars in a Tether bank account.

Due to the damning facts in the above settlements (resulting in nearly $60 million in fines to Tether’s parent company), as well as many other issues including Tether’s longstanding inability to complete an audit, skeptics have long considered Tether’s asset backing suspect at best and smoke-and-mirrors at worst.

It’s not just Tether’s individual investments that prompt head-scratching, but also their eerily static ‘shareholder capital cushion’ (assets minus liabilities):

What’s so strange about this is that, on a daily basis, both Tether’s assets and its liabilities change pretty frequently, and sometimes by significant amounts. Yet the difference between the two — the net assets or ‘shareholder capital cushion’ value shown above — is almost completely unchanging except for dates on which they release quarterly attestations (seen in the annotated vertical lines).

On those dates, the cushion changes abruptly overnight, almost as if it is being manually altered to match the values reported in the attestations.

All of which leaves a deeply unsatisfying status quo: if Tether’s self-reporting and quarterly attestations can’t be believed, how will we ever determine whether they’re insolvent?

This is where my Tether Insolvency Calculator fits in. The financial writer Patrick McKenzie has blogged extensively about Tether and has hit upon a fundamental insight that leads to a more straightforward way of evaluating Tether’s solvency. Rather than attempting to determine the truthfulness of any individual quarterly attestation, we can simply accept it at face value and, given its reported asset allocation, form reasonably solid conclusions about Tether’s solvency using Tether’s own self-reported data:

As McKenzie wrote in November:

The Consolidated Reserves Report alleges that Tether’s reserves included, as of September, $2,617,267,750 of “Other Investments (including digital tokens)” and $6,135,946,415 of Secured Loans.

These assets must have been impaired in the last six weeks. If they are not, Tether would have a legitimate claim to being the best risk managers. Not in crypto, no, in the history of the human race.

The risk-on assets are 12.86% of the reserves, via simple division. Their equity is 0.36% of assets. (No, I did not forget to multiply by a hundred when converting to percent.)

If their risk-on assets were impaired by more than about 2.86%, Tether must have (by their own numbers) needed recapitalization. Again.

It is not credible that they suffered no serious impairment. Bitcoin, the blue chip cryptocurrency, is down by more than 10%. I challenge anyone to find a portfolio construction for digital token investments that possibly survived this environment with only a 2.86% impairment.

In other words, even assuming Tether’s own recent attestation was accurate, they almost certainly slipped into insolvency (unless they obtained additional funding) due to the market performance of the assets they claimed to own.

Reading these pieces made me wish there were a live, interactive way to track the market performance of a hypothetical Tether portfolio over time. So I created it.

The Tether Insolvency Calculator is a good-faith attempt at reconstructing a hypothetical Tether asset portfolio based on their own attestations and statements, as well as public reporting on their investments. Of course, as I note on the site:

Constructing a hypothetical portfolio necessarily entails making some assumptions and arbitrary decisions and is, therefore, subject to potential errors of judgement (not to mention of calculation). Disclaimer: These errors may be significant.

(If you see any errors, please let me know!)

Because building this portfolio in the absence of more detailed asset reporting leaves much room for interpretation, the calculator allows users to modify the asset allocation to any other proportion they deem superior, and the chart automatically updates with new insolvency numbers. For example, here’s what Tether’s portfolio would look like if they’d invested entirely in Bitcoin since their most recent attestation on September 30th:

And here’s what it would look like if Tether were all-in on 4-week Treasuries instead:

Once you choose a different allocation, the Tweet and Share buttons allow you to post your version on social media as well.

Check out the site and let me know what you think!